The Primary Assets of Credit Unions Are

NIMs are expected to continue a downward trajectory in Q3 as the pandemic fully hits credit union balance sheets 322 in Q2. The net worth-to-asset ratio is the primary measure of each credit unions financial strength.

Community Assets Map Google Search Community Engagement Building Self Esteem Business Leadership

FICUs with less than 50 million in assets must maintain a basic written liquidity policy.

. Credit Union Asset Size 1 Requirement. Return on assets was 038 in Q2 2020 down from 060 in 2019. Short-term credit instruments such as large CDs and Treasury bills.

The federal agency defines small credit unions as those with less than 100 million in assets. Information was obtained from the National Credit Union Administration. According to current Prompt Corrective Action PCA regulations a 7 or higher net worth ratio is a well capitalized credit union.

Value of assets of credit unions in the US. For example our 2021 Banking Digital Trust Report found that US customers with above-average digital trust with their banks were more likely to obtain new. Few credit unions are active.

Also credit unions primary financial institution FI status and the trust theyve established with their customers will help them grow business within the digital asset space. Thats 110 fewer than last year at this time. Its the 12th largest credit union in Arizona with assets totaling 59255 Million and providing banking services to more than 43000 members.

There were 3387 of them by that measure at yearend 2020 representing 664 of all federally insured credit unions. Debit card interchange and fees. Credit union member business lending including the types and sizes of businesses that receive.

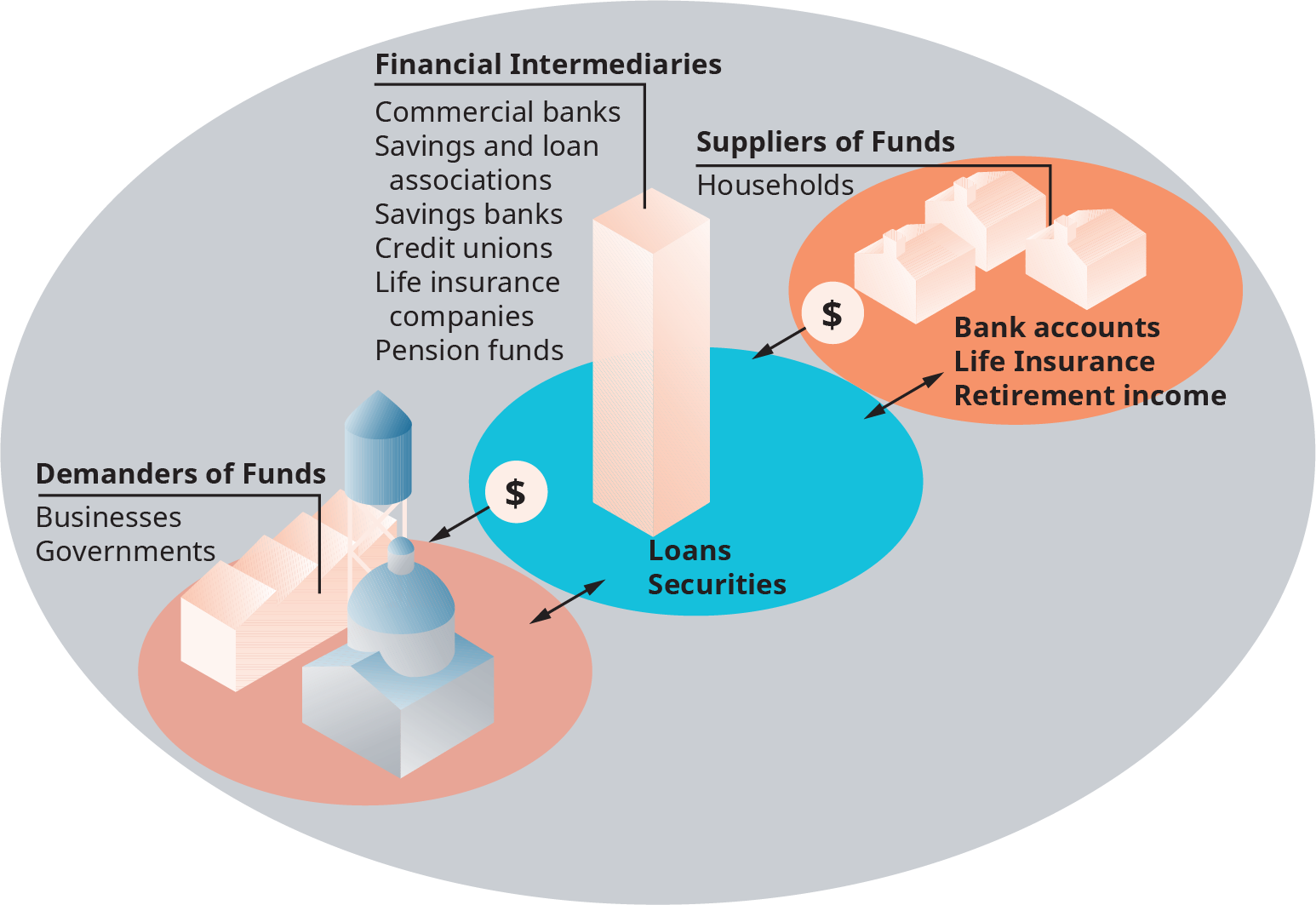

Debit credit and prepaid card interchange income. Mortgages comma stocks comma bonds comma and real estate. Savings and Loan Associations Primary Liability- Deposits.

The policy must provide a credit union board-approved framework for managing liquidity and a list of contingent liquidity sources that can be employed under adverse circumstances. What are the primary assets of credit unions. 50 million or more.

Consumer debt and long minus term mortgages. The NCUA lists 5098 credit unions in total. The primary assets of credit unions are deposits the primary liabilities of a The primary assets of credit unions are deposits the School Southern Methodist University.

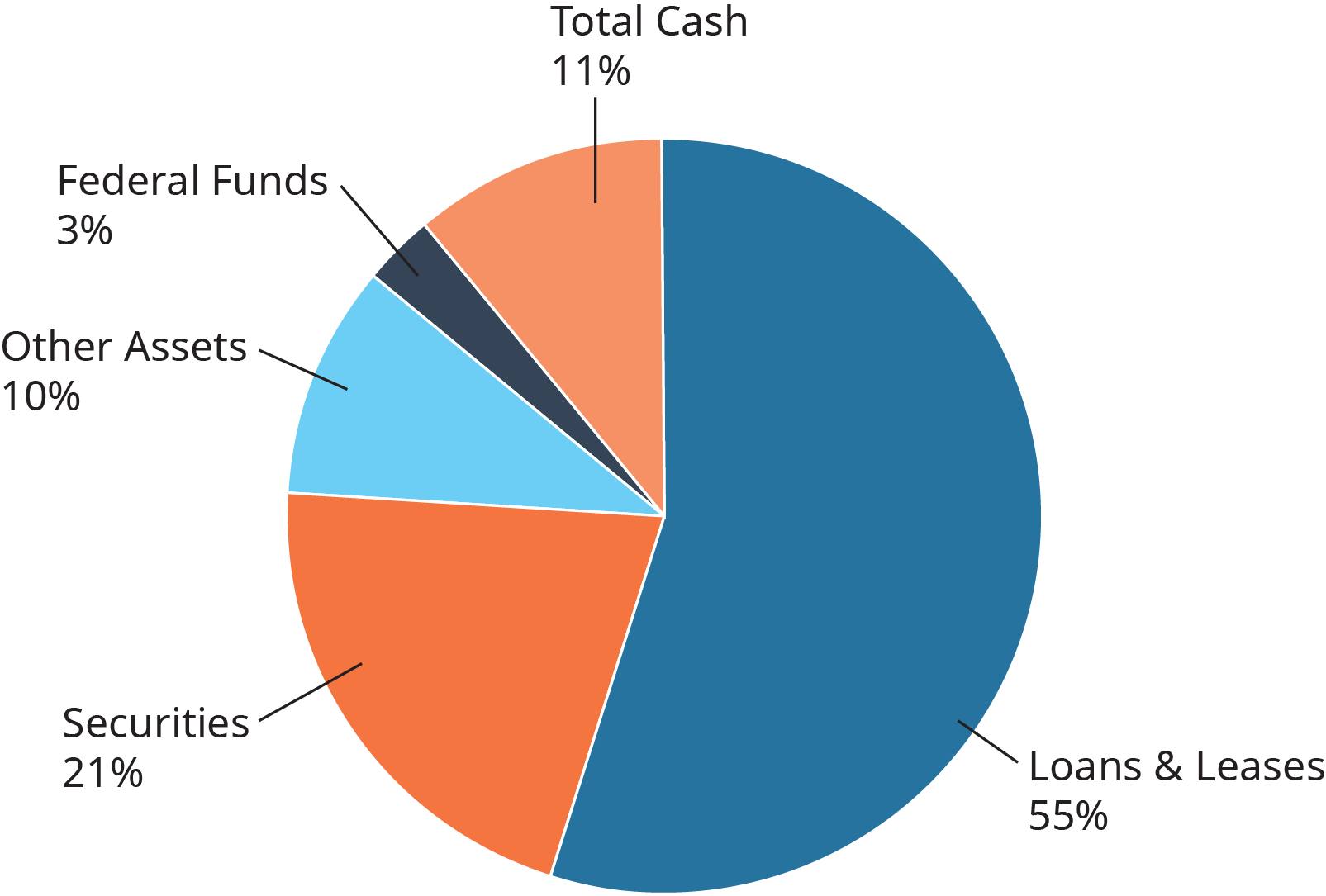

Cash and liquid assets. The primary assets of credit unions are A municipal bonds. Compared to 230 million for the median bank The smallest credit union on the list is Holy Trinity Baptist Credit.

Compared to 35 billion for the average bank The median assets under management is 35 million. The average credit union has an average of 286 million in assets. By contrast many of the largest credit unions grew rapidly in both assets and members in 2020.

Credit unions started to experience net interest margin NIM compression in Q1 2020 falling to their lowest levels since 2017. The primary assets of credit unions are a municipal. Madison WI April 11 2022 Madison-based UW Credit Union reached 5 billion in assets for the first time this past Friday a significant milestone in its 90-year history and a.

Checking and savings including non-sufficient funds and courtesy pay income. Government securities and municipal bonds. Norrestad Mar 4 2021.

Short minus term credit instruments such as large cds and treasury bills. Credit unions are not-for-profit and are owned by their members and according to the Credit Union National Association 120 million Americans belong to one. The 25 credit unions ranked on The List collectively had assets of 56 billion in 2019 an increase of 1 billion from 2018.

Primary Assets- Business and consumer loans mortgages US. Car loans and consumer debt business loans government securities mortgages. Less than five percent of the smallest credit unions under 10 million in total assets offered this product.

23 The primary assets of credit unions are A municipal bonds. In a 2016 Callahan survey of 170 credit unions the largest reported sources of non-interest income from the lists above were. Credit Unions Ownership and Membership.

Totally assets in federally insured credit unions as of June 30 2020 were 175 trillion. Primary 1-4 family residence and loans the total of which to an individual is less than 50000. Credit unions assets primarily consist of.

Property plant and equipment. Investment and insurance sales. Consumer debt and long-term mortgages OB.

The increase in total assets of credit unions in. 9 Net Worth To Assets. The credit unions net worth is all of the credit unions earnings since inception.

Car loans and consumer debt comma business loans comma government securities comma mortgages. What are the primary assets of credit unions. Copper State Credit Union formerly known as Canyon State Credit Union has been open since 1951.

Credit Unions Benefits Types Regulations

Closed End Home Equity Application Credit Union Form Http Www Oaktreebiz Com Products Services Closed End Home Equi Home Equity Home Equity Loan Loan Account

Banks Credit Unions Savings Institutions What Are The Differences

U S Financial Institutions Introduction To Business

U S Financial Regulatory Structure 2016 Financial Regulation Financial Regulatory

Noble Bank Private Banking Best Website Web Design Inspiration Showcase Private Banking Web Design Inspiration Lawyer Logo Design

:max_bytes(150000):strip_icc()/dotdash-insurance-companies-vs-banks-separate-and-not-equal-Final-9323c943f9974aad96b2c70d6e3aa577.jpg)

Insurance Companies Vs Banks What S The Difference

Credit Counselling Credit Counseling Financial Education Money Management

Exberry Appoints Guy Melamed As The New Chief Executive Finance Saving Accelerated Reading Banking Software

Icici Vcc The Virtual Credit Card Enables You To Transact Online With A Credit Limit Of Your Choice S Virtual Credit Card Best Credit Cards Bank Credit Cards

Unison Creative Branding And Marketing Agency In Hong Kong Home Creative Branding Marketing Agency Branding

U S Financial Institutions Introduction To Business

The Deposit Insurance Reserve Fund Adequacy Assessment Framework Report Financial Services Regulatory Authority Of Ontario

Joel Lobb Kentucky Loan Google Home Buying Checklist Home Buying Mortgage Checklist

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

How Bay Area Credit Union Began Bay Area Credit Union Formerly Known As Sohio Toledo Refinery Credit Union Was Chartered By Refinery Credit Union Ohio State

/GettyImages-184657765-7b98f9c00724400f94cb21ca293506b9.jpg)

Comments

Post a Comment